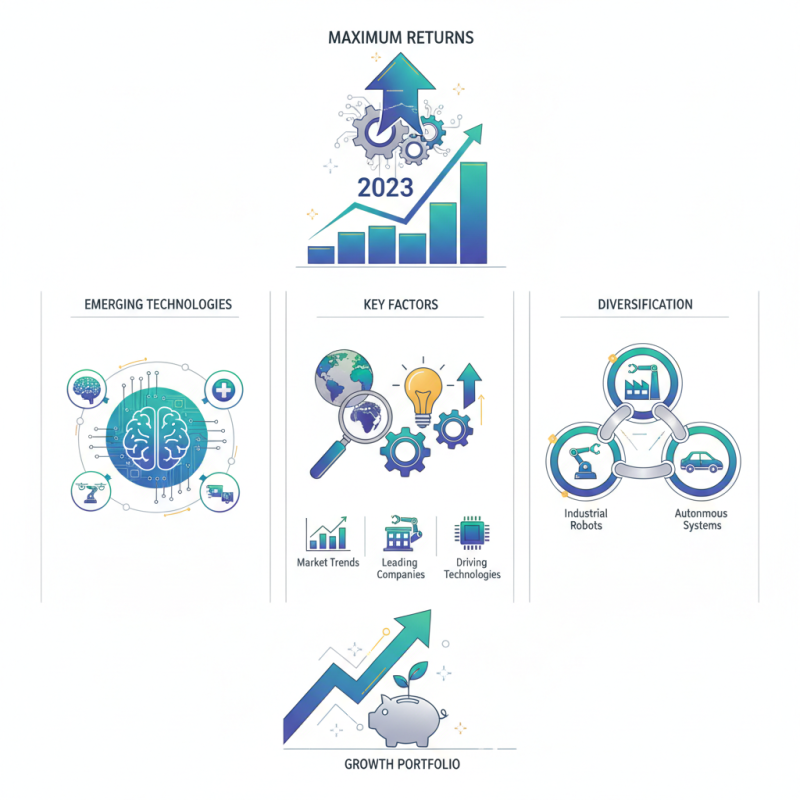

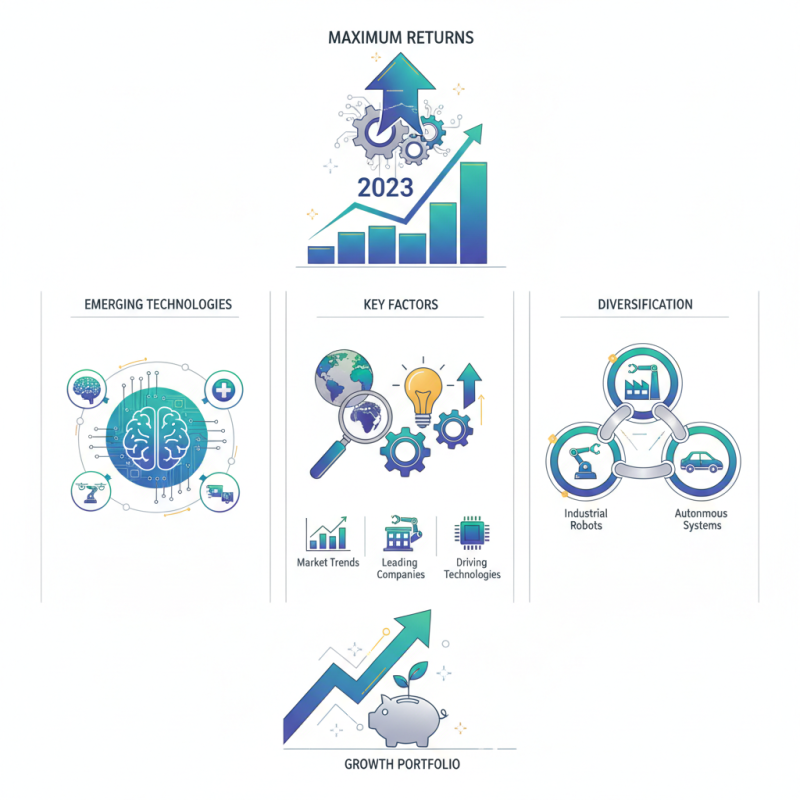

How to Invest in Robotics Stocks for Maximum Returns in 2023

Investing in emerging technologies has become a popular strategy for those seeking maximum returns, and one of the most promising sectors today is robotics. As automation continues to revolutionize industries from manufacturing to healthcare, understanding how to invest in robotics stocks can provide significant opportunities for growth. With advancements in artificial intelligence, machine learning, and automation technologies, the robotics market is expected to expand rapidly. Investors are increasingly recognizing the potential for lucrative returns as businesses integrate robotic solutions to enhance productivity and efficiency.

To navigate this dynamic landscape, it is essential to comprehend the key factors influencing robotics stock performance. This includes evaluating market trends, identifying leading companies within the sector, and understanding the technologies driving innovation. By focusing on these elements, investors can make informed decisions that align with their financial goals. Moreover, diversification across various subsets of robotics—including industrial robots, service robots, and autonomous systems—can effectively manage risk while tapping into multiple growth avenues.

In 2023, the opportunity to invest in robotics stocks has never been better, with the continuous evolution of technologies and increasing demand for automation. Whether you are a seasoned investor or new to the market, understanding how to engage with this field can lead to maximum returns and enhance your investment portfolio in the years to come.

Understanding the Robotics Industry and Market Potential in 2023

The robotics industry is poised for significant growth in 2023, driven by advancements in artificial intelligence, automation, and machine learning. As businesses seek to increase efficiency and reduce costs, the demand for robotic solutions is expected to surge across various sectors, including manufacturing, healthcare, and logistics. This evolving landscape presents a lucrative opportunity for investors looking to capitalize on the robotics market's potential.

To navigate this burgeoning industry effectively, it's essential for investors to stay informed about key trends and technological breakthroughs. Understanding the various applications of robotics, such as autonomous vehicles, robotic process automation, and collaborative robots, can provide insight into where the market is headed. Additionally, keeping an eye on regulatory developments and industry partnerships can highlight which companies are positioned for success in this rapidly changing field.

Tips: One effective strategy for investing in robotics stocks is to diversify your portfolio by targeting companies across different segments of the industry. This approach not only mitigates risk but also maximizes the potential for returns. Furthermore, consider following industry reports and expert analyses to identify emerging players and trends that may signal growth opportunities. Staying engaged with market developments will give you a competitive edge as you navigate your investment journey in robotics.

Investment in Robotics Stocks - Growth Potential in 2023

Key Factors Driving Growth in Robotics Stocks This Year

The robotics industry is poised for considerable growth in 2023, driven by several key factors that are reshaping the landscape of automation and artificial intelligence. According to a recent report by McKinsey, the global robotics market is expected to reach $500 billion by 2030, with a compound annual growth rate (CAGR) of 20% over the next few years. This growth is fueled by increased adoption across various sectors, including manufacturing, healthcare, and logistics, as businesses seek to enhance efficiency and reduce operational costs.

One significant factor driving this surge is the growing demand for automation in response to labor shortages and rising wages. A report from PwC highlights that nearly 45% of jobs within the manufacturing sector could be automated in the coming decade, pushing companies to invest in robotics to maintain competitiveness. Further, advancements in artificial intelligence and machine learning are enabling more sophisticated robotic solutions, leading to enhanced capabilities and expanding applications. As industries look to leverage these technologies, investors can anticipate substantial returns by focusing on companies that are at the forefront of this technological evolution.

Identifying Leading Robotics Companies and Their Innovations

The robotics industry is rapidly evolving, with significant innovations that position leading companies at the forefront of technological advancements. According to a report by the International Federation of Robotics (IFR), the global industrial robotics market is expected to reach $70 billion by 2025, driven primarily by increased automation in various sectors. Companies that excel in artificial intelligence and machine learning are creating more sophisticated robots that enhance productivity and efficiency across industries such as manufacturing, healthcare, and logistics.

Identifying these key players involves analyzing their recent innovations and contributions to the field. Research from MarketsandMarkets indicates that advancements in collaborative robots, or cobots, are particularly noteworthy, as they work alongside human workers to augment their capabilities rather than replace them. This technology presents a compelling investment opportunity, as companies leading the charge in cobot development are projected to grow at a compound annual growth rate (CAGR) of over 30% through 2024. By focusing on these transformative technologies and the companies behind them, investors can strategically position themselves to capitalize on the growing demands of automation in the future.

How to Invest in Robotics Stocks for Maximum Returns in 2023 - Identifying Leading Robotics Companies and Their Innovations

| Company Type |

Sector |

Market Cap (in Billion $) |

Recent Innovation |

Growth Rate (Projected %) |

| Industrial Robotics |

Manufacturing |

25.5 |

AI-Driven Automation Tools |

12% |

| Healthcare Robotics |

Healthcare |

18.2 |

Surgical Assistance Robots |

15% |

| Service Robotics |

Service Industry |

10.3 |

Delivery Drones |

20% |

| Agricultural Robotics |

Agriculture |

6.5 |

Autonomous Harvesting Machines |

10% |

| Consumer Robotics |

Consumer Electronics |

3.1 |

Smart Home Robots |

25% |

Analyzing Investment Strategies for Robotics Stocks

When considering investment strategies for robotics stocks in 2023, investors should first focus on identifying the key sectors driving growth in this field. Industries such as manufacturing, healthcare, and logistics are increasingly adopting robotics technology to enhance efficiency and reduce labor costs. Analyzing market trends and technological advancements within these sectors can help investors pinpoint which companies are likely to see significant growth. It's essential to look at the broader economic context and how automation trends are influencing these sectors, as this will allow you to make informed decisions.

Another crucial strategy is to diversify investments across various companies within the robotics sector. Instead of placing all funds in a single firm, spreading investments helps mitigate risk while maximizing potential returns. Investors should look for companies that not only produce robotic technologies but also those involved in software development and integration, as these components are critical to the success of robotic solutions. Keeping track of emerging players in the market, along with established firms, can provide a balanced portfolio that stands to benefit from the overall growth of the robotics industry, creating opportunities for solid returns in the evolving tech landscape.

Risks and Considerations When Investing in Robotics Stocks

Investing in robotics stocks presents a promising opportunity, but it is essential to understand the inherent risks and considerations involved. One significant risk is the volatility of the technology sector, where rapid advancements can quickly shift market dynamics and affect stock performance. Investors must remain vigilant about the pace of innovation and potential disruptions, as companies may experience sharp fluctuations in their stock prices based on new developments or market competition.

Another critical consideration is the varying degrees of regulatory scrutiny that robotics companies may face. As these technologies advance, they often attract the attention of regulators concerned with safety, privacy, and ethical implications. Investors should evaluate how well a company navigates these regulatory landscapes and the potential financial impact of compliance. Additionally, it's vital to engage in thorough research; understanding the fundamentals of a robotics company, including its financial health, market position, and growth prospects, will better inform investment decisions and help mitigate risks associated with this sector.

+91-97254 16844

+91-97254 16844